In one of the first posts I wrote for this blog, I talked about bitcoin profit and, more specifically, I considered possible definitions of success regarding bitcoin mining (see How to be successful at bitcoin mining? if you are interested; it is a 2-minute read).

It’s been only about 3 weeks since then, and NiceHash profitability seems to have fallen through the floor. Or has it?

I feel like it is time to revisit the topic and share some more thoughts about what happened and how I intend to measure success with my BTC earnings experiment.

Several important things happened during these past 3 weeks:

- Many more people started mining for coins. This one was expected, as many blogs and news outlets reported that it was once more possible to make money using GPU for mining. See the NiceHash stats for Dagger Hashimoto here for more info on this; the impact of newcomers is best visible there, because DH is favored for GPU mining. Note: make sure to click on ‘All’ to see the whole trend.

- Mining difficulty is raising. This is how the blockchain reacts to increase in hash power. This in turn reduced coin profitability for everybody. No wonder there.

- BTC lost nearly more than 23% of its (recently, record-high) value. This directly influenced the easiest measure of success: profit measured in fiat currency (USD, EUR…) because it compounded the drop of BTC earnings with the drop of exchange rates.

So by the looks of it, this new bubble seems to have burst. But has it, really?

What Is ‘Normal’ Profitability Anyway?

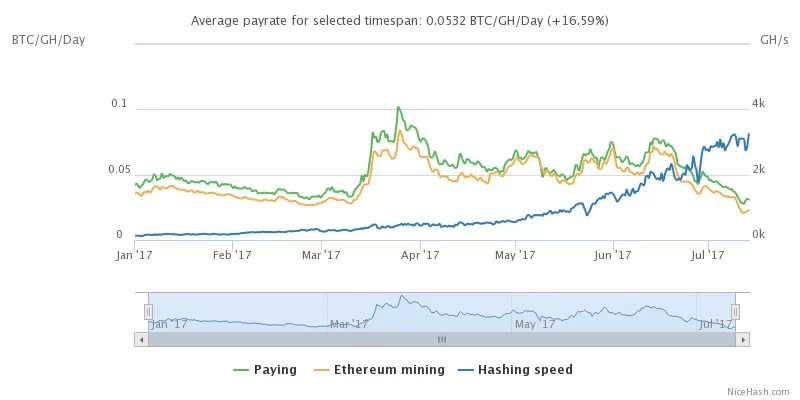

For those of you who were too lazy to follow the link I gave above, here’s the chart:

The BTC earning levels now are similar to these between last January and March, before Ethereum mining exploded. So now we arrive at a level of profitability that held for a relatively long time (sadly, the chart offers no information for past years).

Checking my own profitability for the last 6 weeks or so, it is declining slowly from an average of 0.0020 BTC/day to 0.0014 BTC/day 1. The hashing speed of the network for the same period has doubled, yet I see only 30% drop in relative profitability. If this trend continues, it doesn’t look too bad. Buyers still seem to be paying well despite the huge uptick of ETH power available for selling.

What Microeconomy Teaches Us

There is a truly awesome introductory course in Economic Principles by Stanford Professor John Taylor which I highly recommend to anybody who wants to do business. The Market Equilibrium lecture explains how and why every market eventually achieves a state of balance with zero net profit.

As long as net profit stays above zero, new economic agents will seek to enter that particular market. Agents that operate on the market at a loss will seek to leave it. This process naturally gravitates towards net zero.

External events (substantial change in materials costs; changes in legislation) will periodically upset that balance, but given enough time, the market will reach a new equilibrium.

Market Equilibrium is King

Bitcoin mining can be explain perfectly by the Market Equilibrium model. Right now we seem to reach the end of an adjustment cycle caused by significant shifts in external factors:

Recent rise in the value of crypto currencies → Influx of miners → Increase in price of mining hardware that constricts the influx → Increase in mining difficulty → …?

I expect that a period of relative stability of BTC payouts coming soon. I can only hope that this equilibrium will arrive at a point but above my fixed costs. At that point, it will no longer be possible to sell hash power and make a meaningful profit selling the coins.

Not What You Bargained For?

If you are here for the quick buck, this is certainly not a good situation for you. But this is a standard economic situation that we understand well. You’d never be able to mine for Bitcoin, Ethereum, Zcash and make big profit in fiat currency for a prolonged period of time. If you thought otherwise, perhaps you should take that economy course to understand why you were wrong. But if you are here for the long run (which is a rather silly thing to say two weeks before SegWit, he he), not everything is lost.

Why I am not (Yet) Bothered

Soon, I will no longer to profit from selling bitcoins earned with NiceHash. But I will still be getting BTC in exchange for the work my GPU is doing! As long as have even a minimal amount of BTC left after paying my electricity bill and covering amortization costs for my hardware, things will still be OK. This income will still be ‘free’ money and I will keep considering the experiment a success. As long as I have confidence in the future of Bitcoin, achieving even a small amount of bitcoin profit will be enough for me to keep mining.

Bitcoin Profit: Further Actions Needed

In another blog post, I wondered about best mining efficiency. Back then I came to the conclusion that in a profitable market (the value of bitcoins earned is much greater than the cost of electricity & hardware amortization) the best course of action is to push for maximum GPU performance, power consumption be damned.

But now I am rapidly approaching a situation where my MSI GTX970 rig makes very little profit. If I reduce power limit from 180W to 100W, I save more on my electricity bill (~45%) than I lose from mining (10~15%). In periods of market equilibrium, costs optimization is of highest importance.

What is your take on all of this? Do you share my opinion or do you think I am out of my mind? Let me know in the comments below.

I am a small business owner from Bulgaria. I have been tinkering with personal computers ever since I was a kid. I feel enchanted by Bitcoin technology; last time I felt this excited was some 23 years ago when I first started surfing the internet using a 28.8k modem.