Among the daily flood of news regarding cryptocurrency, there is a growing section dedicated to ICOs (Initial Coin Offerings) for newer and ever weirder kinds of tokens. These ICOs follow the same logic: a white paper is published, trying to explain the uniqueness of the new coin and its application, and a purchase schedule is provided.

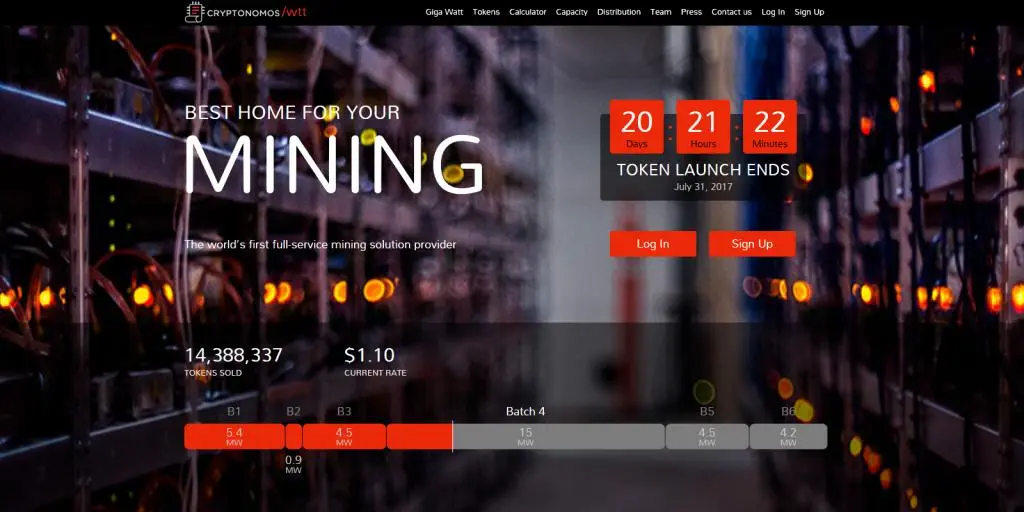

Today I decided to have a look at the Giga Watt ICO which is kind of louder than usual right now. After reading their Token Launch White Paper, well… all I can conclude is that the Facepalm is strong with this one.

Giga Watt claim they have the know how and capacity to build efficient mining data centers, and to supply coin mining equipment. As part of the ICO they offer to build and rent such facilities, and offer ownership over this rental space in the form of Giga Watt Project Tokens (WTT). WTT tokens give owners the right to use the Giga Watt facilities free of charge for a period of 50 years, starting from the issuance of the coin. (50 years is the projected lifespan of the Giga Watt facility).

The way accommodation is calculated is a bit weird. Instead of renting space per square meter, units of rackspace, or power capacity, the Giga Watt Project Tokens measure rent in terms of power consumption. This is done without consideration of the physical size or the electrical efficiency of the equipment that consumes that power. 1 WTT allows for the accommodation of equipment consuming 1 Watt of power.

What is a Giga Watt Token (WTT)

Here is how this works with real-life numbers. If you want to install an Antminer S9 and run it at 13.5TH/s, you will need 1.323 kW worth of power. In order to accommodate this equipment with Giga Watt, you need to pay rent to the amount of 1455.3 WTT (1 WTT per Watt plus 10% surcharge; 1 WTT = $1.00 at the beginning and set to grow by $0.05 in each of the four stages of the ICO).

If you don’t have WTT tokens, you can either buy or rent them from somebody. Giga Watt vouch that they will accept rental payments only via WTT tokens.

You’d still be paying for setup, electricity, facility maintenance and on-site repairs to your equipment but the tokens will supposedly cover your costs for rack space for a period of 50 years, thus increasing your overall profit margin.

Giga Watt are betting upon the idea that home miners who are unable to build facilities of their own would prefer to use a suitable facility due to the cheaper electricity and better operating conditions rather than trying to cope with the noise and heat at home. Giga Watt are letting you use such facility and will even sell you the equipment which goes there. Note that the profit from the sale and maintenance of mining equipment goes solely to Giga Watt. Your purchase of WTT tokens only grants you rack space use.

Note: the white paper makes no provisions for accommodating 3rd party equipment, but the Giga-Watt website suggests that they can do it. But how efficient it is to ship a miner accross the States, or across the world? Will such costs be recuperated over the lifespan of the device? I am betting the answers are negative and that Giga Watt are hoping users will be buying their equipment from them.

Anyway, there are so many things wrong with the model of this ICO that I just don’t know where to begin.

Expiry Date?!

OK, let’s start with the fact that this is the first crypto token that I know of that has a fixed expiry date. Once the token is minted, you can use it for the lifespan of the facility, which is projected at 50 years. What happens then?

Imagine all the bills and coins in your pocket having an expiry date after which they can’t be used to buy anything, anywhere. Would you hold onto such currency or would you be looking for any way possible to get rid of it?

This is fully ass-backwards approach to token scarcity. Nobody is going to invest in something that will die at a predetermined date, and if somebody does, the price of this ‘asset’ is bound to fall with time because it has a frikkin’ expiry date. Remember, the lifetime of each WTT is constant, regardless of whether somebody is using the associated rack space during that time or it stays idle. After the facility lifecycle is spent, the WTT become worthless.

(Not) Controlling Scarcity

One of the main reasons Bitcoin constantly rises in value is its designed scarcity. With only 21mn coins ever available for mining, it is only natural that their price will grow when their utility grows. But nothing prevents Giga Watt from building more and more Giga Pods if their utility increases. In fact, they suggest fast expansion in the white paper:

WTT can be used from the very first date of issue. Giga Watt facility’s unique design allows for record-fast expansion, and the first units can be operated while the new ones are still being built.

And also:

New batches of tokens will be issued in step with the construction of new facilities.

Bottom line: your WTTs will never appreciate in value so long as Giga Watt keeps building Giga Pods and issues new batches of tokens. Because Giga Watt will profit from onboarding more miners, they have no motive to keep the cost of new WTT tokens high during subsequent offerings. They want equipment on these racks burning electricity and breaking down, so that they can charge for power, maintenance and on-site repair. Heck, nothing stops them from setting lower price per token in future offerings!

Is $1 Really Worth Rack Space Costs for 50 Years?

It probably is, but only if the seller intends to keep their end of the bargain. However what if the cost of electricity in Wenatchee, WA (where the Giga Watt facilities will be built) goes up next year and it is no longer cost efficient to use your equipment there? Or just imagine the owners of Giga Watt getting bored and moving on to do other things.

There is absolutely nothing in this ICO that proves you will get any practical use out of the tokens you will be buying, however cheaply. There is no formal commitment on behalf of the Giga Watt team. Nobody can look half a century into the future. The 50 years’ lifespan is just a number designed to be impressively big. It is a red herring that shifts the attention away from the other glaring problems of these tokens.

Selling or Renting Giga Watt Tokens

In order to use the Giga Watt facilities, you need tokens. You can get these by buying or renting them. However the rate is not set by the free market but instead is regulated by Giga Watt themselves. Says the WTT White Paper (I have marked the important language for emphasis):

Token holders who are not personally interested in mining or have spare tokens can rent them out via the Partner’s rental module on Giga Watt’s web-site, choosing one of the rental fees set by Giga Watt. Token rental fees are the same as the Giga Watt’s facility rental fees, which are 4.20, 4.95, 5.7 and 6.45 US cents/kW/h, depending on the number of miners hosted (see Section “Giga Watt’s pricing”). It translates into daily rental income of ¢0.1-0.15 per token (¢37-57 per year).

Remember that Giga Watt and its stake holders have different interests:

- Token owners want to profit from selling or renting their tokens at later date when there is greater demand

- Giga Watt wants to run facilities, sell mining equipment and bill users for electricity, ongoing maintenance an on-site repair

Giga Watt have no interest to make accommodation expensive, because this will reduce their income. Also, for every 100 tokens purchased during the ICO, Giga Watt will issue a further 15 tokens which it will distribute among its staff. So Giga Watt will at any time compete against token owners to keep token costs down. And if that is not enough, they can always build more facilities.

Also, note the payout scale. If the number of mining units per user grows, the user gets a lower rental rate from Giga Watt and your rental income falls down, while their income comes up. Investment “nirvana”!

An Example

Imagine a venue hosting an event. You have already purchased a ticket but for some reason you can’t go. However there are still a plenty of tickets available as the event date approaches. I learn about the event, I decide I want to attend it and the event and so I go to the venue and buy a ticket from there.

As long as tickets are readily available, I have no initiative to look around and try to find somebody else who has already purchased a ticket and doesn’t want it. And until the ticket office no longer has tickets left to sell, they have no initiative to turn me away and saying you have a ticket that you no longer want. Remember, the venue is making money from selling tickets. Even if the ticket office knows you aren’t going, they have no motive to even suggest to me that I could look for you and try to buy your ticket. Heck, if the venue sells all tickets, the organizers have every incentive to offer a second date for the event in order to earn even more. This is exactly how Giga Watt can screw its ICO buyers.

In Conclusion

I will probably never know if the Giga Watt owners are that naïve, or whether they are dastardly smart and rely on people’s greed and stupidity to ride the bitcoin craze as hard and as long as it will go. But here I put myself on record saying that I strongly believe this Giga Watt ICO is a giant bullshit which deserves to fail.

I am a small business owner from Bulgaria. I have been tinkering with personal computers ever since I was a kid. I feel enchanted by Bitcoin technology; last time I felt this excited was some 23 years ago when I first started surfing the internet using a 28.8k modem.