Well, folks — it looks like SegWit is here to stay.

This change to Bitcoin protocol promises, among other things, a reduction in the cost of bitcoin transaction fees, which have been growing by leaps and bounds (more than 1200% in two years). They have become unreasonable to the point of abandoning one of the major promises of Bitcoin: the ability to make payments for free or inexpensively.

I haven’t been able to find a good source of historical stats yet, but bitcoinfees.21.co is a great tool to check current size of bitcoin transaction fees that guarantees immediate inclusion in the block chain. I will keep an eye on these stats for some time to see how they will change between now and the end of November, and will log these changes here.

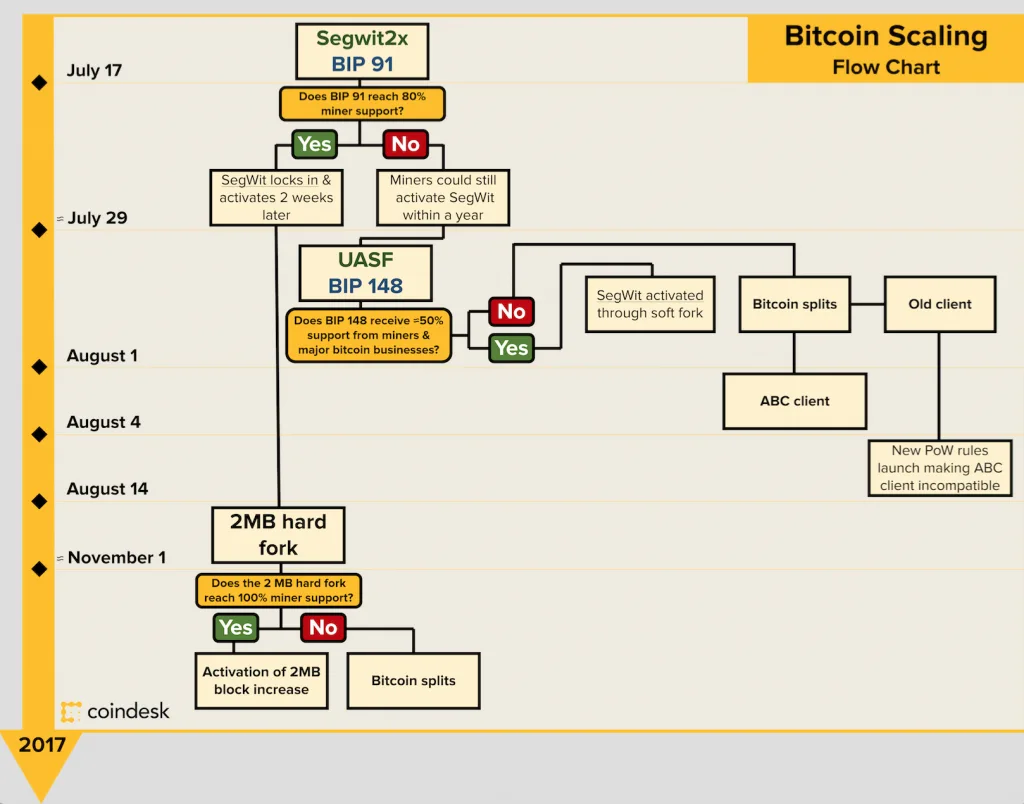

Why end of November? I have selected a period between the actual SegWit2x lock-in date (2 days from now) and the following 4 months or so based on the timeline reported by Coindesk (see below). This should give us some sense as to where things are going and whether the whole effort will lead to reduced transfer fees. (Remember, SegWit2x is now about to lock in, but the rules of the game will only change a couple of months down the line.)

Jul 21, 2017: Average fastest and cheapest Bitcoin transaction costs 260 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 58,760 satoshi. Jul 30, 2017: Average fastest and cheapest Bitcoin transaction costs 240 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 54,240 satoshi. Aug 1, 2017: Average fastest and cheapest Bitcoin transaction costs 60 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 13,560 satoshi. Aug 2, 2017: Average fastest and cheapest Bitcoin transaction costs 120 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 27,120 satoshi. Aug 3, 2017: Average fastest and cheapest Bitcoin transaction costs 140 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 31,640 satoshi. Aug 14, 2017: Average fastest and cheapest Bitcoin transaction costs 300 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 67,800 satoshi. Aug 16, 2017: Average fastest and cheapest Bitcoin transaction costs 340 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 76,840 satoshi. Aug 19, 2017: Average fastest and cheapest Bitcoin transaction costs 240 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 54,240 satoshi. Aug 23, 2017: Average fastest and cheapest Bitcoin transaction costs 450 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 101,700 satoshi. Aug 24, 2017: Average fastest and cheapest Bitcoin transaction costs 450 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 101,700 satoshi. Aug 30, 2017: Average fastest and cheapest Bitcoin transaction costs 360 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 81,360 satoshi. Sep 7, 2017: Average fastest and cheapest Bitcoin transaction costs 270 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 61,020 satoshi. Sep 12, 2017: Average fastest and cheapest Bitcoin transaction costs 100 satoshi per byte. For a median transaction length of 226 bytes, this results in a fee of 22,600 satoshi.

Note #1: the line marked in green above is from The Day Bitcoin Stood Still — the fateful date on which Bitcoin Cash separated from Bitcoin Core. Most Bitcoin exchanges stopped trading a couple of hours before the fork, and many experts recommended people to stop transferring coins until the dust has settled. The result is a lovely 6× decrease in transaction costs and close to 0 waiting time. If only this could go on forever.

Note #2: the lines marked in orange are logged during the most recent BTC price craze. A lot of folks seem to be selling their bitcoins and the ledger is terribly loaded, hence the largest fees I’ve seen so far.

Note #3: the lines marked in red are logged approx. 24 hours before and approx. 6 hours after the activation of SegWit. This new feature promises to reduce the amount of transaction information pushed onto the blockchain by about 75%, with a proportional reduction of transaction fees and reduction of confirmation times. By that point in time, I honestly don’t believe fees will decrease, but… let’s wait and see. Remember, at this time we are not yet moving to 2MB block size. Only Segregated Witness is activated at the moment.

Note #4: by August 30, transaction fees have not yet subsided that much, but the backlog of unconfirmed transactions seems to have decreased significantly.

Note #5: by September 12, bitcoinfees.21.co has begun to catch up with the lower TX fees that I reported on 3 September (see update below for link).

Important update: these fee cost reports may not paint the whole picture. Feel free to ignore the importance of cost information published here until you have read SegWit Works and Fees Drop — For Real.

I am a small business owner from Bulgaria. I have been tinkering with personal computers ever since I was a kid. I feel enchanted by Bitcoin technology; last time I felt this excited was some 23 years ago when I first started surfing the internet using a 28.8k modem.